Nigeria’s Bond Market Surges Following Central Bank Governor’s Suspension

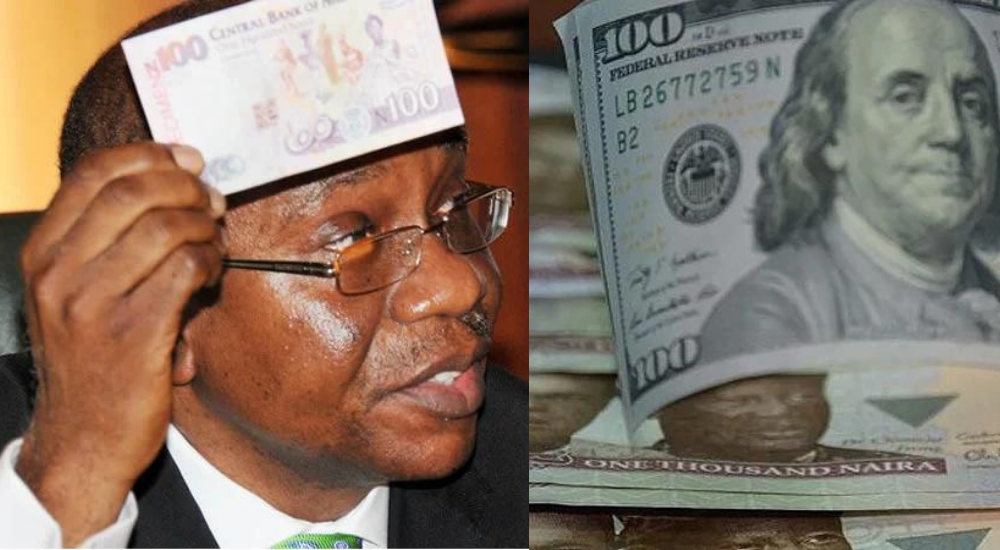

Investors in Nigeria’s sovereign dollar-denominated bonds expressed positivity as the Central Bank governor, Godwin Emefiele, was suspended last week. Emefiele’s management of multiple exchange rates aimed at strengthening the naira proved unsuccessful, leading to a surge in bond prices. Longer-dated maturities experienced the highest gains, with the 2049 maturity rising by 2.353 cents to 80.231, according to Tradeweb data.

Nigeria is currently grappling with a severe scarcity of dollars, resulting in a higher demand for foreign currency on the black market, where the naira’s value is significantly lower than the official exchange rate. The suspension of the Central Bank chief is seen as a signal of a new era of focused and predictable monetary policies, shifting towards a non-interventionist approach in the foreign exchange regime, as noted by Barclays economist Michael Kafe.

President Bola Tinubu, who took office two weeks ago, had criticized Emefiele’s handling of the naira and monetary policies. Tinubu aims to revitalize Nigeria’s struggling economy and has already taken steps such as removing fuel subsidies and working towards consolidating the multiple exchange rates. This proactive approach to addressing economic challenges early in his term suggests Tinubu’s commitment to implementing difficult reforms promptly, as highlighted by Kafe.

In the wake of the suspension, Folashodun Shonubi, a deputy governor, has been appointed as the acting head of the Central Bank. Meanwhile, the suspended governor is currently in custody and under investigation, as announced by the police on Saturday.

In December, a court issued an order preventing the arrest of Emefiele on allegations of “terrorism financing” due to insufficient evidence. It is currently unclear whether the recent arrest over the weekend is related to the same charge.